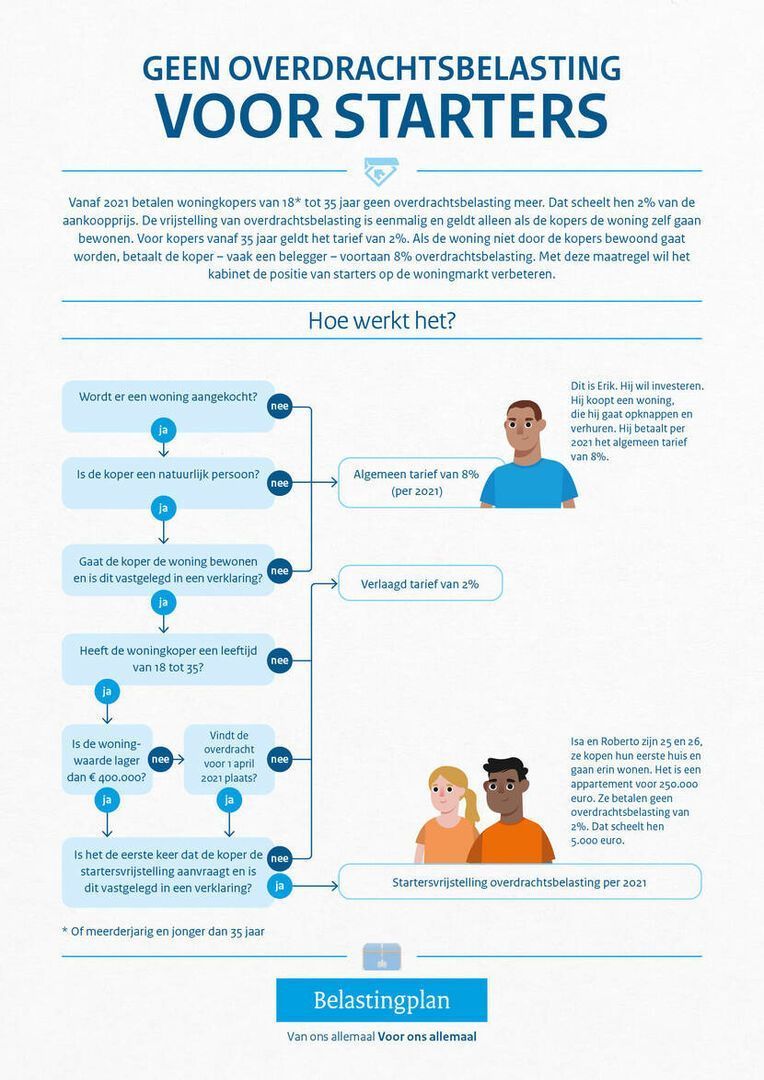

Buyers aged 18 to 35 do not pay a one-off transfer tax when purchasing a home. That makes purchasing a home a lot cheaper for them. From April 1, 2021, the property may not be more expensive than €400,000. Buyers aged 35 or older who live in the home pay 2%. Investors will pay 8%. With these measures, the government wants to give starters and those moving on more opportunities on the housing market.

Conditions for the starters' transfer tax exemption

The buyer must meet a number of conditions to make use of the transfer tax exemption.

The buyer is an adult (18) and younger than 35 years old.

The buyer buys a home.

The buyer has not previously received the starter's exemption for transfer tax and declares this in writing.

The buyer will live in the home himself (the so-called main residence criterion) and declares this in writing.

The home is not more expensive than €400,000 if the transfer takes place after March 31, 2021 (this home value limit does not apply until that date).

Exemption applies to transfer of home from January 1, 2021

The moment of transfer at the notary is decisive, not the moment of signing the purchase agreement. The exemption applies when the transfer of a home takes place at the notary on or after January 1, 2021. Additionally, from April 1, 2021, the exemption only applies to homes cheaper than € 400,000.

1 of buyers 35 years or older: no exemption on their own share

The exemption applies to each buyer individually. Is one of the buyers 35 years or older and the other younger than 35? Then the person aged 35 or older pays 2% tax on his/her share. The person who is younger than 35 years old does not pay tax on his/her share (if he/she also meets the other conditions).

The home does not have to be the first owner-occupied home for exemption

For the exemption, it does not matter whether the buyer has owned a home before. The home does not therefore have to be the buyer's first home for the exemption.

Buyer needs explanation for exemption

The buyer requires a written statement to make use of the transfer tax exemption. In it, the buyer declares that he meets certain conditions for the exemption. This is the condition of self-occupation and the condition that the exemption has not been used before. The buyer gives the declaration to the notary.

8% transfer tax from 2021 if the home is not your main residence

From January 1, 2021, buyers will pay 8% transfer tax if they do not live in the home themselves. For example, if they own the house:

rent out;

use as a holiday home;

buy for a child.

Anyone who wants to make use of the exemption must use the new home as their main residence. This means that the buyer registers with the municipality and also builds his life there (such as sports activities, school, place of worship, childcare, friends, family). This can only be 1 home. For this reason, second homes and holiday homes, even if they are not rented, also fall under the 8% rate. Housing cooperatives do not pay 8% transfer tax but 2% when they buy houses from housing associations.