It is difficult to find a home. Utrecht is doing its utmost to make (and keep) as many homes available as possible for people looking for a home. For example, by building new houses.

Some examples of projects that started in 2020:

Wonderwoods (more than 400 homes) on Jaarbeursplein

De Kwekerij in Utrecht East (244 homes)

De Nieuwe Defensieterrein in de Merwedekanaalzone (1st phase 291 homes)

The Cube in Overvecht (639 homes)

Huize Nijevelt in Vleuten de Meern (32 homes)

Wisselspoorkwartier at the 2nd Daalsedijk (1st phase 122 homes)

Plan: 60,000 additional homes by 2040

The plan is to create approximately 60,000 additional homes in the period up to 2040. That is about 3,000 per year. Construction of between 2,800 and 3,100 homes will start in 2021. The municipality expects the start of construction of between 2,600 and 3,200 homes by 2022.

Thousands of homes will be added in Utrecht in the coming years. We also want to ensure that it remains pleasant to live. That is why they also spend a lot of money on public space. The following projects will start (or have already started) in 2021:

1st phase cartesius triangle (more than 300 homes)

Smakkelaarsveld (150 homes)

Opaalweg (200 student homes)

A.B.C. street 5 (104 homes)

A number of large construction projects with many homes will start in 2022 and 2023. Such as Wisselspoor/2e daalsedijk sub-area 2-4, Cartesiusdriehoek (follow-up phases) and Merwedekanaal zone.

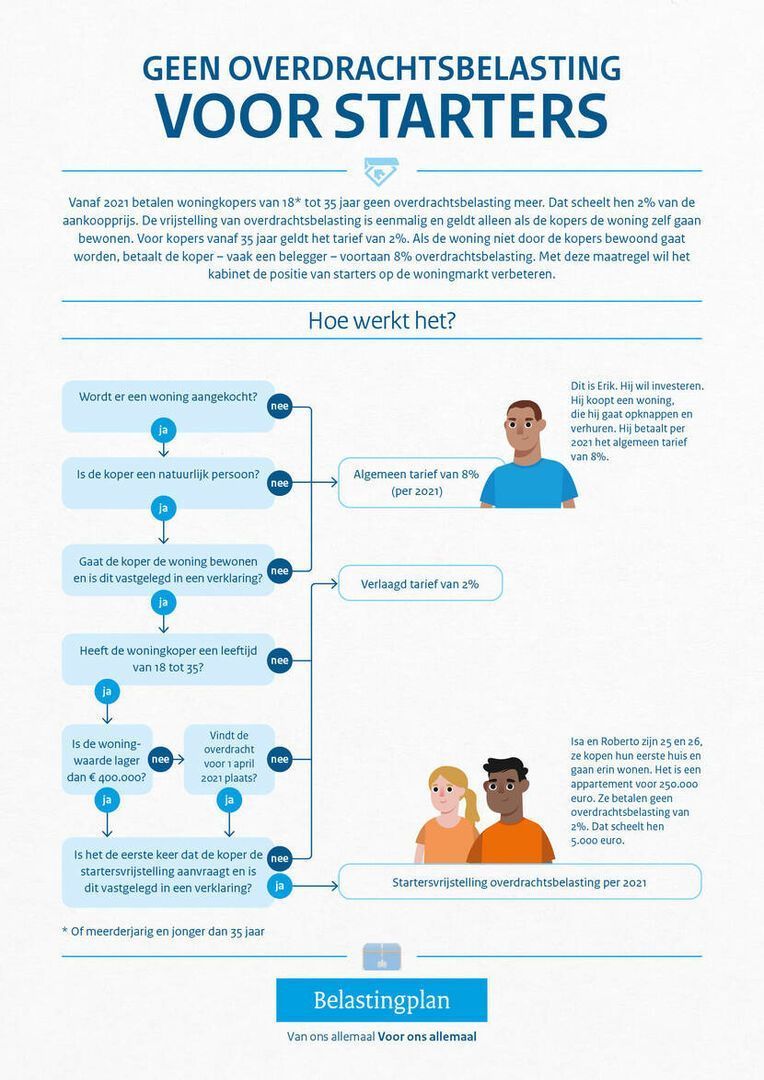

New rules for owner-occupied homes

For some time now we have had a 'self-occupancy obligation' for new construction in Utrecht. Anyone who buys a new-build house must live in it themselves and cannot immediately rent it out to someone else.

We now want a new rule for existing houses: 'purchase protection'. Anyone who buys a house may not rent it out for at least 4 years.

More about buyback protection

We want a ban throughout the city on renting out a house with a WOZ value of up to € 440,000 after the purchase. The purchase protection will probably apply from mid-March. The municipal council will soon decide on this new rule.

The Utrecht housing market is under pressure. Purchasing prices in the city have never been so high. Some of the few affordable houses are bought up by investors. This leads to even fewer owner-occupied homes and therefore rising house prices. Utrecht wants people who want to live in an affordable owner-occupied home to be able to find a place in Utrecht. This new rule will especially benefit starters and buyers with a middle income.

There are 3 exceptions to the purchase protection:

someone may still rent a purchased house to first- and second-degree family (parents, children, brothers and sisters)

someone may rent out a purchased house temporarily, for a maximum of 12 months, for example if the owner is going on a long trip

someone may rent out a purchased house as a business home

A permit will soon be required for such an exception.

There may be 2 more exceptions:

new construction projects in which rental agreements have been made

In cases where renting out a house is very important, the municipal council will decide

The above offers various opportunities and risks. We are happy to advise our customers.

PEEK&POMPE MAKELAARS